Does insurance cover cataract surgery?

Does insurance pay for cataract surgery?

Cataract surgery is usually covered by insurance when it's "medically necessary." In most cases, this means your insurance and eye doctor agree that a cataract is causing noticeable vision problems, and surgery is the best way to treat it.

Which insurance covers cataract surgery?

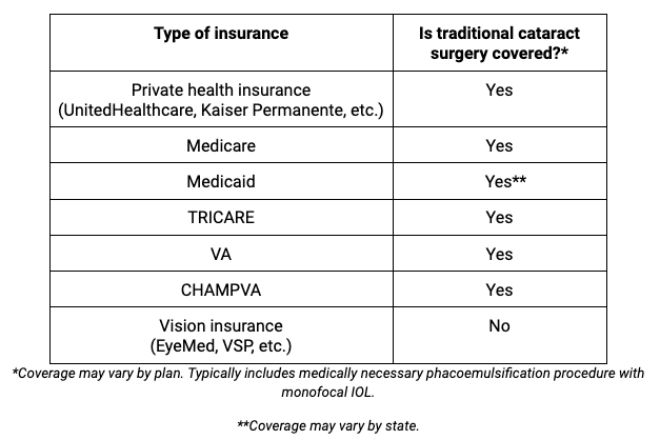

Cataract surgery is covered by health (medical) insurance.

Vision insurance does not cover cataract surgery, even though your vision is involved. Instead, it's used to lower the costs of routine eye care like eye exams and prescription glasses or contact lenses.

Surgeries and specialist appointments — like cataract removal and ophthalmologist visits before and after surgery — usually fall under health insurance.

Here's how different kinds of coverage handle the procedure:

Click to enlarge.

If you have private medical insurance, cataract surgery should be covered regardless of whether you have an HMO, PPO or another plan. But different kinds of plans can require different steps.

For example, if you have an HMO, you'll probably need a referral from your primary care physician before you visit an in-network ophthalmologist. That way, you can be sure you're paying the lowest rates for your procedure and exams.

READ MORE: Should I see an optometrist or ophthalmologist?

What does insurance cover?

Most health insurance plans cover:

Traditional cataract surgery

During a basic procedure, the doctor uses ultrasound waves to break the cloudy lens into small pieces and then vacuum them out.

This is called phacoemulsification — the most common type of cataract removal in the United States. Insurance should cover it as long as it's medically necessary.

The doctor might choose a slightly different procedure if your cataracts are severe.

There are often separate charges for doctor fees, facility fees and anesthesia (if you have to be sedated or put to sleep). Check with your doctor's office to ensure they're all covered by your insurance.

A standard artificial lens

The surgeon places an artificial lens (IOL) inside your eye after they remove your cloudy natural lens. In many cases, insurance will fully cover one kind of artificial lens — a monofocal lens.

Monofocal lenses correct your vision at one distance. They're usually set to help you focus on farther objects instead of closer ones. But in some cases, the patient would like the lens focused for near vision. They then wear glasses for distance vision.

Doctor visits before and after surgery

You'll need to see your ophthalmologist for a consultation before surgery and several follow-up appointments after surgery.

New glasses after surgery (sometimes)

Many people still have to wear glasses or contact lenses once their eyes adjust to the new IOL, especially when monofocal IOLs are used.

Normally, prescription eyeglasses and contacts fall under vision insurance coverage. But Medicare will cover a pair of standard prescription glasses or contacts after surgery for people enrolled in Plan B.

What does insurance not cover?

Most insurance will not fully cover:

Premium lenses

There are many kinds of IOLs, but insurance usually only covers monofocal IOLs.

Special, "premium" IOLs can help some people see better without glasses after surgery. Some of them are:

Multifocal – These have different focus "zones" that let you focus at near and far distances. These lenses are also known as “trifocal” and “bifocal” IOLs.

Accommodating – These shift and change shape to help you focus at multiple distances.

Toric – These are carefully aligned inside your eye to help with astigmatism.

A basic monofocal lens will fix cataract symptoms for most people, so insurance companies usually consider premium lenses optional.

You could have higher out-of-pocket costs if you choose a premium IOL.

Laser surgery

Surgeons can use laser cataract surgery to create pinpoint incisions and help break up the cloudy lens before removing it. It can help the doctor treat a severe cataract or place a multifocal IOL more accurately.

Insurance rarely covers this kind of surgery. It can cost a lot more than a traditional procedure, especially if it's paired with a premium lens.

What can affect my out-of-pocket costs?

Insurance may cover cataract surgery, but it probably won't pay for all of it. You'll be responsible for any leftover costs after insurance pays their part.

The total cost of cataract surgery could depend on your:

Deductible – The amount of money you have to spend in a plan year before your insurance starts helping with costs.

Coinsurance – The percentage you pay after you reach your deductible.

Copayments (or "copays") – Set rates you pay for certain services, such as $50 for each specialist appointment.

Out-of-pocket maximum – The most money you can spend on covered costs in one plan year.

Coverage network – Your in-network doctors and facilities (usually more affordable than out-of-network providers).

Surgery fees billed – The amount your doctors and facilities bill for their services. Your insurance may also have an agreement to pay less with certain providers.

These factors won't apply to every kind of coverage, so it helps to check with your insurance for specific details.

Can I use my HSA or FSA together with insurance?

Yes — health savings accounts (HSA) and health care flexible spending accounts (health care FSA or HCFSA) can be great ways to lower your surgery costs, even after insurance is applied.

These accounts let you pay for approved medical expenses with pre-tax money.

Your savings will depend on the total cost of surgery, how much you contributed to the account that year and how much you still have left in the account.

The maximum contribution limits for 2023 are:

HSA: $3,850 for individuals, $7,750 for families

Health care FSA: $3,050

Your FSA limit could be lower, depending on your employer.

READ MORE: HSA vs. FSA

Check with your insurer

Cataract surgery insurance coverage can vary from plan to plan. It never hurts to double-check the details with your doctor's office and insurance beforehand, even when you've been pre-authorized for surgery.

If you haven't been diagnosed with cataracts or haven't found a surgeon, call an eye doctor near you to schedule an appointment.

Vision coverage. HealthCare.gov. Accessed October 2023.

Health insurance coverage in the United States: 2021. United States Census Bureau. September 2022.

Cataract surgery: Risks, recovery, costs. EyeSmart. American Academy of Ophthalmology. November 2023.

Eyeglasses & contact lenses. Medicare.gov. Accessed October 2023.

Does TRICARE cover cataract surgery? TRICARE. September 2023.

Comparing cataract surgery complication rates in veterans receiving VA and community care. Health Services Research. July 2020.

Cataract. EyeWiki. American Academy of Ophthalmology. November 2023.

Avoiding surprises in your medical bills: A guide for consumers. Healthcare Financial Management Association. 2018.

Factors to consider in choosing an IOL for cataract surgery. EyeSmart. American Academy of Ophthalmology. December 2022.

Cataract surgery. National Eye Institute. January 2023.

Cataract surgery: What to expect before, during and after. Harvard Health Publishing. April 2023.

Billing for post-cataract glasses: What you need to know. American Optometric Association. March 2018.

IOL implants: Lens replacement after cataracts. EyeSmart. American Academy of Ophthalmology. November 2022.

Toric IOLs. EyeWiki. American Academy of Ophthalmology. November 2023.

Understand the benefits of laser cataract surgery. Duke Health. June 2022.

Deductible. HealthCare.gov. Accessed October 2023.

Coinsurance. HealthCare.gov. Accessed October 2023.

Copayment. HealthCare.gov. Accessed October 2023.

Out-of-pocket maximum/limit. HealthCare.gov. Accessed October 2023.

Allowed amount. HealthCare.gov. Accessed October 2023.

The difference between a flexible spending account (FSA) and a health savings account (HSA). National Institutes of Health, Office of Human Resources. Accessed October 2023.

Publication 502 (2022), medical and dental expenses. Internal Revenue Service. February 2023.

Health savings account (HSA). HealthCare.gov. Accessed October 2023.

Using a flexible spending account (FSA). HealthCare.gov. Accessed October 2023.

IRS announces spike in 2023 limits for HSAs and high-deductible health plans. Society for Human Resource Management. April 2022.

2023 health FSA contribution cap rises to $3,050. Society for Human Resource Management. October 2022.

Page published on Monday, April 13, 2020

Page updated on Tuesday, December 12, 2023

Medically reviewed on Tuesday, December 5, 2023